Executive Recruiting Best Practices: Showcasing Your Research Results

Whether you’re doing research at an executive search firm, an in-house or corporate executive recruiting team, or an institutional investor, at some point you will need to demonstrate the competence and thoroughness of your work. Executives are key hires and represent the future success for the company. Your stakeholders will want to know you’ve left no stone unturned.

Just having a LinkedIn Recruiter account won’t cut it. You need to show you have a solid research process and you need to transparently report on the results of that process. Let’s take a look at both.

A Research Process for Executive Recruiting

More often than we’d like to admit, we start a new executive search by hopping on LinkedIn and clicking through profiles. That’s not really a process and it certainly won’t impress the client or your boss.

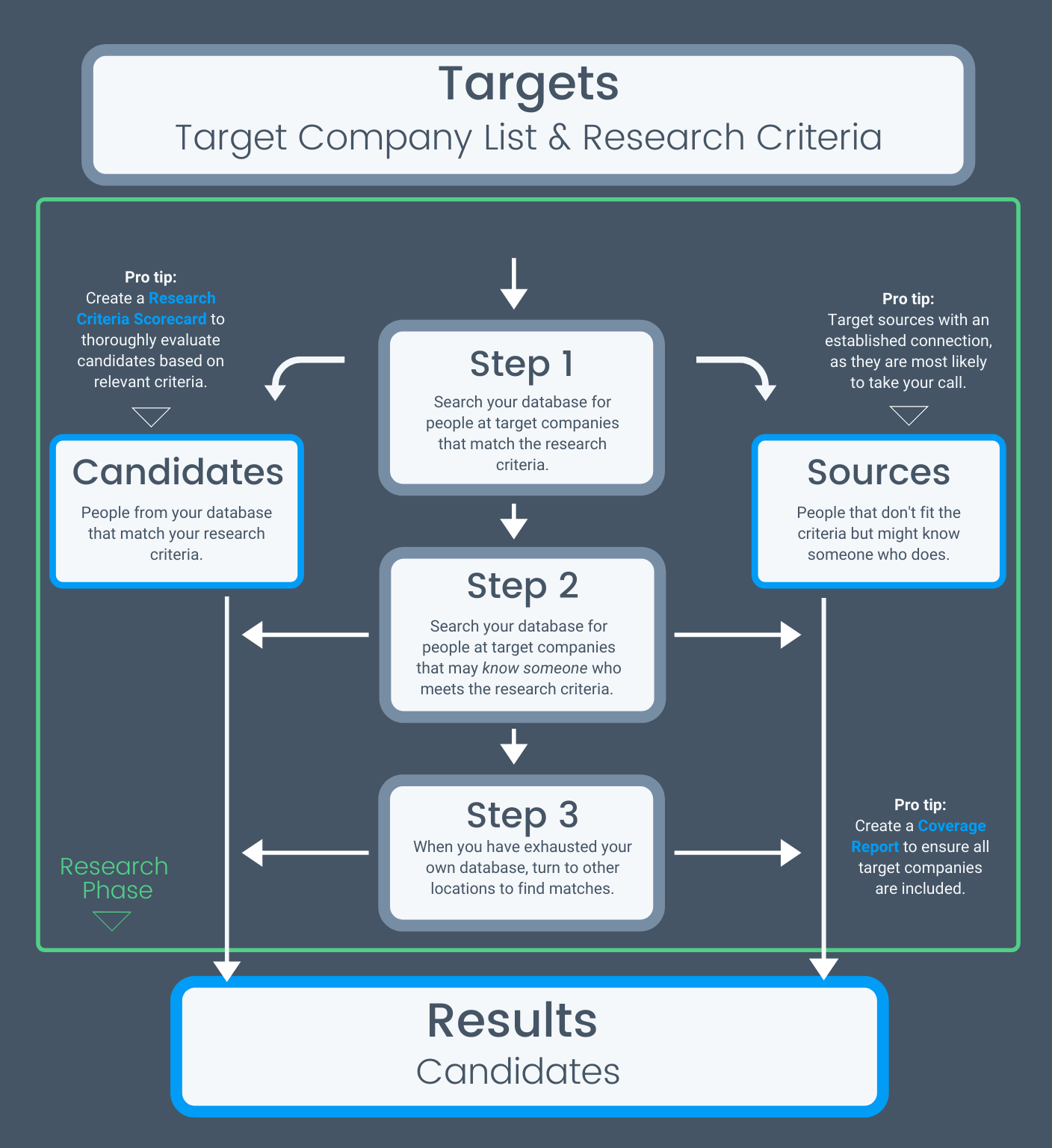

Below is a workflow diagram that represents a typical research process for executive recruiting. First, you should have well-defined research criteria and a target company list from your strategy setting session. This requirement cannot be stressed enough. If you don’t have this information, you will undoubtedly spend time researching the wrong candidates. The time spent on strategy is small compared to the time wasted looking for the wrong candidates. Go back to your client or internal stakeholder and get the information you need.

Now, rather than going straight online to look for candidates, start your research by leveraging your existing database. Perhaps you’ve run a similar search before and can leverage that work. First, search your database for people at target companies that match the research criteria. You should largely find candidates with an established connection. These are most likely to take the call during your outreach.

Next, search your database for people at target companies that may know someone who meets the research criteria. It could be someone from the same department but is at a different level seniority from what is specified in the search criteria. Or perhaps they are a peer in terms of seniority but in an adjacent department. These are often referred to as sources. They’re not an exact fit, but they might know someone who is. Largely you will have an established connection with these contacts as well, so they’ll also be most likely to take a call during your outreach.

You’ll want to note whether your resulting contacts are candidates or sources. Whether you have someone else on your team do outreach or you handle it yourself, this information will be key to guiding those conversations. Indeed, after getting them on the phone you might find that some of your candidates are sources and vice versa.

Once you’ve exhausted your database, then turn to other locations like LinkedIn to find matches. Again you’ll want to look for candidates and sources. Keep in mind that these contacts will be cold, they’ll be the least likely to take your call. So you’ll want to also note whether a contact came from your own database or outside.

Let’s face it, the reality is that scraping LinkedIn for cold executive candidates isn’t high-value work. They’re cold and not likely to respond to outreach because there is no prior contact or established connection. Your response rates will be much lower and you will have to consider many more candidates. To help optimize their time towards higher-value work, we often see executive recruiting teams hire junior staff or contract out the LinkedIn research piece. We have a number of Research Partners that can help, and they know Executive Search and know how to use Clockwork.

If you’ve established a research process like the one outlined above, you’ll want to share this part of the executive search process with your clients or internal stakeholders. Develop a diagram like the one above and walk them through it. It will demonstrate your competence and thoroughness as a researcher.

Showcase Results With Reports

The result of research is a long list, often a very long list. It’s not realistic for your client or internal stakeholder to review every single one of them.

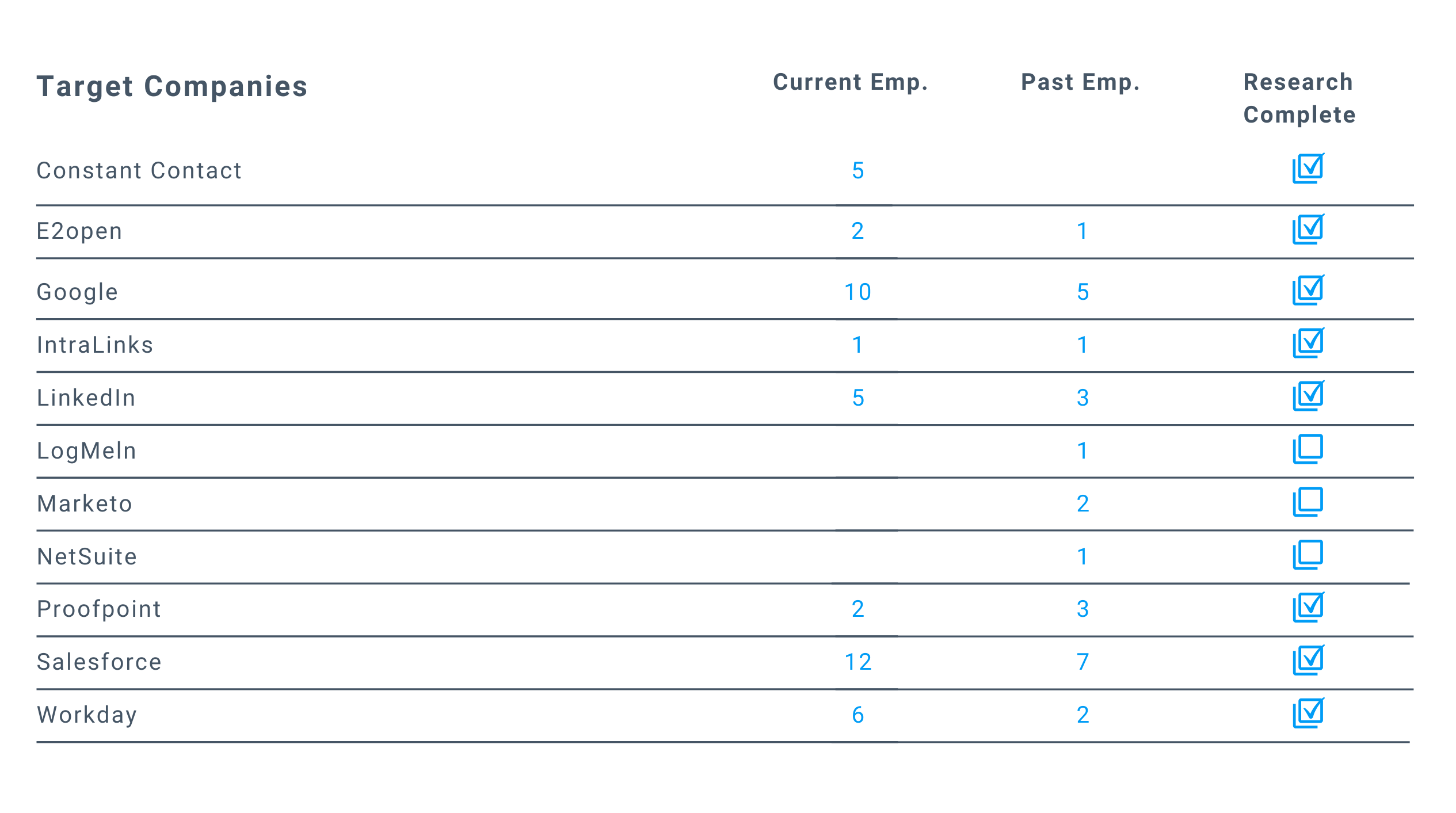

Instead, use a Research Coverage Report to summarize the research results to ensure you have adequate coverage of the Target Company List from your strategy session. An example Research Coverage Report is shown below. It shows the number of current and past employees you’ve found at each of the target companies. It doesn’t show the details of these candidates, that information is covered in the Research Criteria Scorecards discussed below.

The Research Coverage Report can be updated and provided to your client or internal stakeholder each week or every two weeks to show your overall research progress. And as an added bonus, the Research Coverage Report helps you identify gaps at target companies that you can then use to further optimize your cold research on LinkedIn.

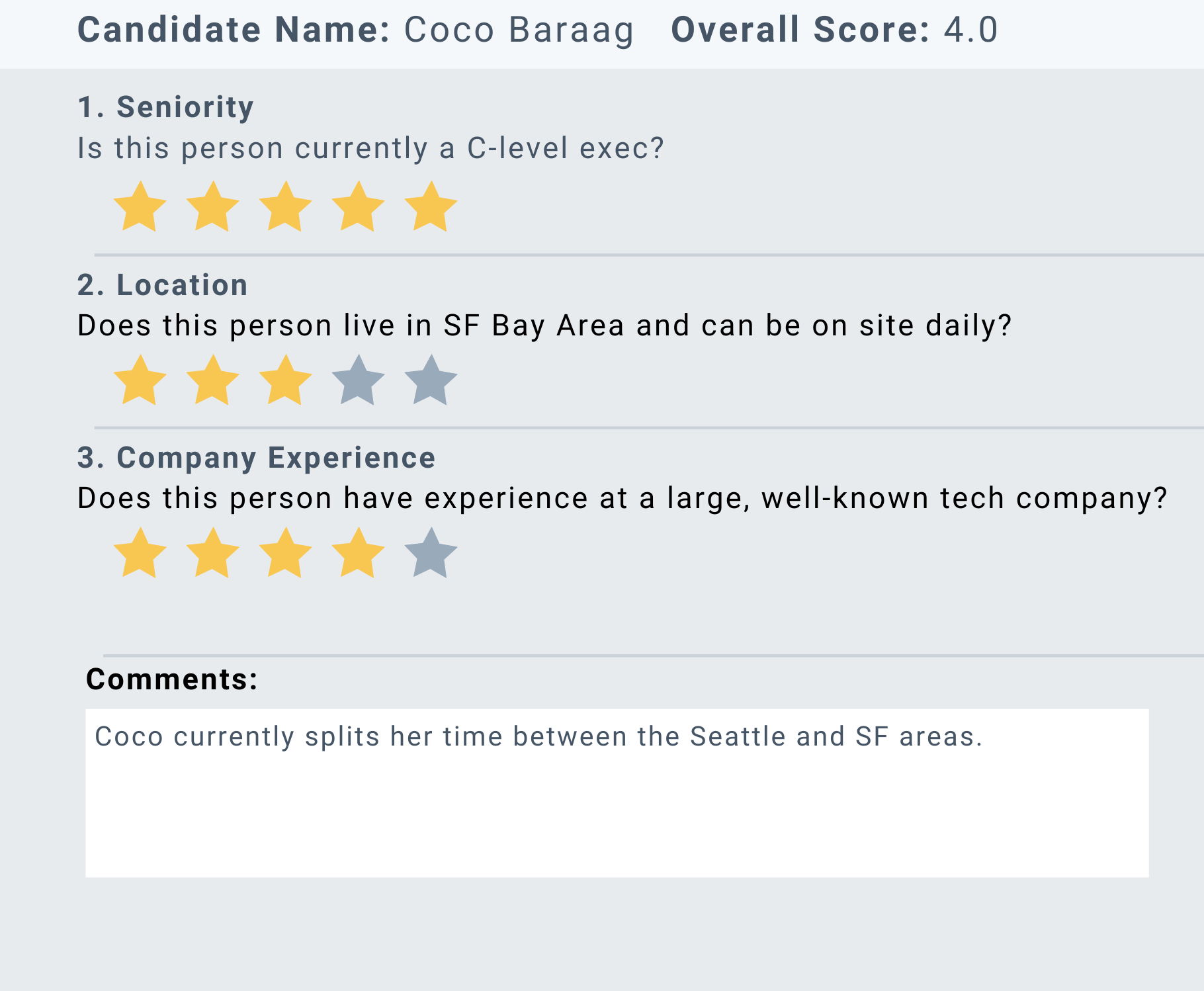

For details on a particular candidate, use a Research Criteria Scorecard. These scorecards show the fit of the candidate vs. the research criteria established in the search strategy session. For example, it may indicate if they have the right amount of experience or the right level seniority. The scorecard should have as many items as necessary to completely cover the research criteria.

Note that the Research Criteria Scorecard is initial information from the research stage prior to talking with the candidate. It does not include information such as interest or availability of the candidate which is uncovered and reported later.

One of the biggest mistakes in Executive Search is for research to be a behind-the-scenes blackbox. Don’t leave your client or internal stakeholders in the dark for weeks. Show them your executive search process and report on your results. It really is an opportunity to showcase your work.

Research is one of the most time-consuming stages of Executive Search. Having a software system like Clockwork can dramatically accelerate research on a search project. Clockwork is more than just a database, it has the search tools and filters to support your research process. And Clockwork has the reporting and collaboration features to showcase your work to your clients or internal stakeholders.

The workflow diagram and example reports in this article are from Clockwork’s free online course on The Eight Stages of Successful Retained Search. Register today for many more examples and best practices.

The Eight Stages of Successful Retained Search

- Intro to the Eight Stages of Successful Retained Search

- A.I.'s Future Impact On The Executive Search Process

- Search Firms Are Divided If A.I. Can Intelligently Source and Assess Finalist Candidates

- Search Firms Believe A.I. Will Have Little Impact On Final Stages Of A Search.

- Search Firms See A.I. Supplementing Most Of Their Marketing Efforts

To learn how The 8 Stages of Successful Retained Search are incorporated and supported in Clockwork, read our support documentation. To see it in action, view this playlist of videos.

Christian Spletzer

After years of working as an executive recruiter, Christian Spletzer founded Clockwork to improve how search firms and clients work together on retained search projects. He designed Clockwork to help recruiters demonstrate their consultative value to their clients at every stage of each project.